Obamacare Individual Responsibility

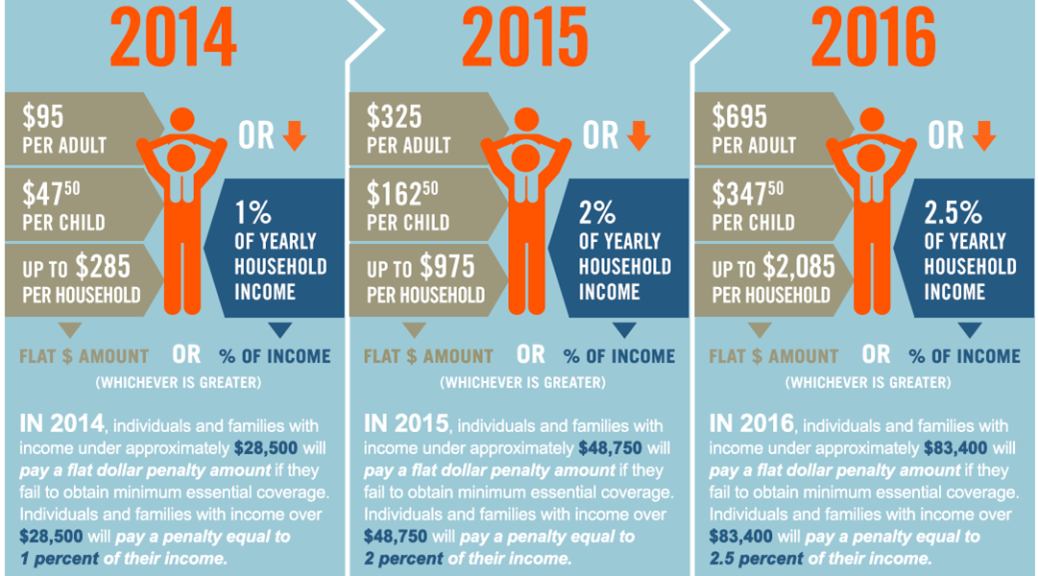

The Affordable Care Act includes the Obamacare Individual Responsibility provision that requires you, your spouse, and your dependents to have qualifying health insurance for the entire year, report a health coverage exemption, or make a payment when you file.

Who is subject to this provision?

All U.S. citizens living in the United States, including children, senior citizens, permanent residents and all foreign nationals are subject to the Obamacare Individual Responsibility provision.

Children are subject to Obamacare Individual Responsibility provision.

- Each child must have minimum essential coverage or qualify for an exemption for each month in the calendar year. Otherwise, the adult or married couple who can claim the child as a dependent for federal income tax purposes will generally owe a shared responsibility payment for the child.

Senior citizens are subject to Obamacare Individual Responsibility provision.

- Both Medicare Part A and Medicare Part C (also known as Medicare Advantage) qualify as minimum essential coverage.

All permanent residents and all foreign nationals who are in the United States long enough during a calendar year to qualify as resident aliens for tax purposes are subject to the Obamacare Individual Responsibility provision.

- Foreign nationals who live in the United States for a short enough period that they do not become resident aliens for federal income tax purposes are not subject to the individual shared responsibility payment even though they may have to file a U.S. income tax return.

- Individuals who are not U.S. citizens or nationals and are not lawfully present in the United States are exempt from the individual shared responsibility provision. For this purpose, an immigrant with Deferred Action for Childhood Arrivals status is considered not lawfully present and therefore, is eligible for this exemption even if he or she has a social security number. Claim coverage exemptions on Form 8965, Health Coverage Exemptions.

- U.S. citizens living abroad are subject to the individual shared responsibility provision.

- However, U.S. citizens who are not physically present in the United States for at least 330 full days within a 12-month period are treated as having minimum essential coverage for that 12-month period. In addition, U.S. citizens who are bona fide residents of a foreign country or countries for an entire taxable year are treated as having minimum essential coverage for that year.

- All bona fide residents of the United States territories are treated by law as having minimum essential coverage.

Please call if you have any questions or need more information.